Introduction

A balance sheet calculates your net worth by comparing your financial assets (what you own) with your financial liabilities (what you owe). The difference between the two is your personal net worth.

Net Worth = Assets – Liabilities

Assets

Assets can be classified into three distinct categories:

- Liquid Assets: Liquid assets are those things you own that can easily be sold or turned into cash without losing value. These include checking accounts, money market accounts, savings accounts and cash. Some people include certificates of deposit (CDs) in this category, but the problem with CDs is that most of them charge an early withdrawal fee, causing your investment to lose a little value.

- Large Assets: Large assets include things like houses, cars, boats, artwork and furniture. When creating a personal balance sheet, make sure to use the market value of these items. If it’s difficult to find a market value, use recent sales prices of similar items.

- Investments: Investments include bonds, stocks, CDs, mutual funds and real estate. You should record investments at their current market values as well.

Liabilities

Liabilities are merely what you owe. Liabilities include current bills, payments still owed on some assets like cars and houses, credit card balances and other loans.

Net Worth

Your net worth is the difference between what you own and what you owe. This figure is your measure of wealth because it represents what you own after everything you owe has been paid off. If you have a negative net worth, this means that you owe more than you own.

Two ways to increase your net worth are to increase your assets or decrease your liabilities. You can increase assets by increasing your cash or increasing the value of any asset you own. One note of caution: make sure you don’t increase your liabilities along with your assets. For example, your assets will increase if you buy a house, but if you take out a mortgage on that house your liabilities will also increase. Increasing your net worth through an asset increase will only work if the increase in assets is greater than the increase in liabilities. The same goes for trying to decrease liabilities. A decrease in what you owe has to be greater than a reduction in assets.

source: Investopedia

Don’t be discouraged if your net worth is negative—keep in mind that this should be an accurate depiction of your financial situation. Setting goals is much easier once you know what your current net worth is.

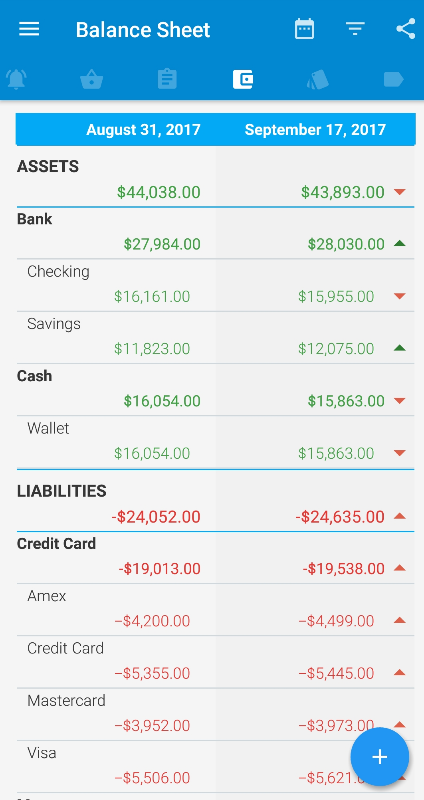

Balance Sheet in Bluecoins

The main balance sheet in Bluecoins is located in one of the sliding tabs.

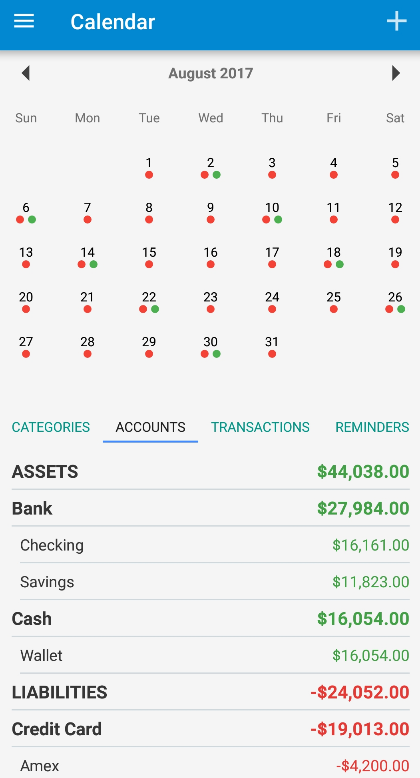

It is also located in the Calendar (under Accounts), and here, you have more flexibility to see your personal balance sheet at any point in time by selecting a particular date.

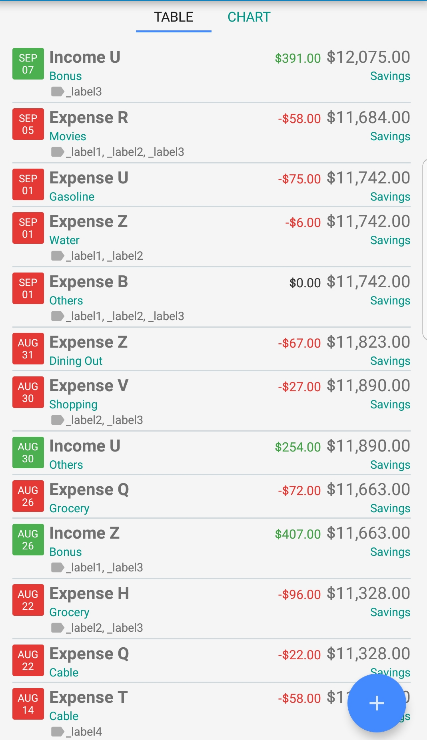

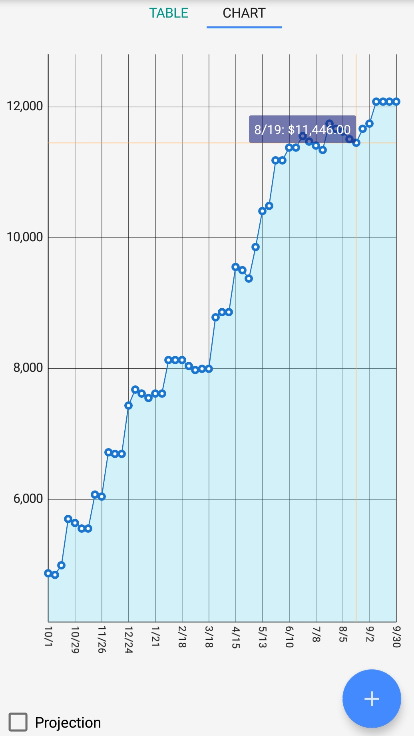

The balance sheet list all of your accounts, organized by either assets or liabilities, as well as the groups they belong in (see Account Groupings here). Clicking an account on the balance sheet takes you to the list of transactions belonging to that account, as well as the graph of the account balance over time.

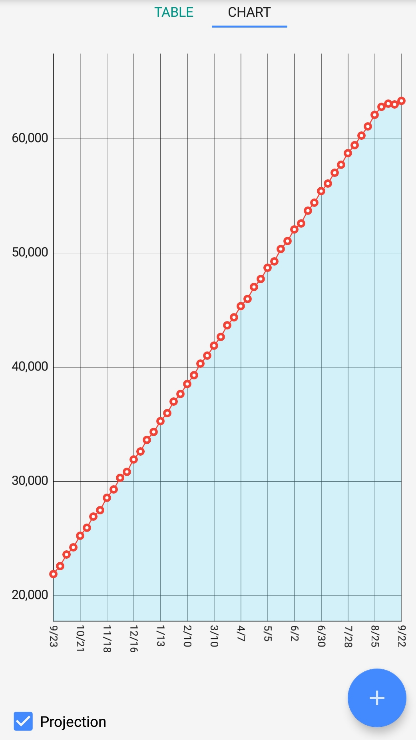

In addition, you can see a future of your account balances by checking the Projection checkbox at the bottom left corner. The projection will be calculated from your upcoming reminders and payment transfers involving the selected account.

How To Reconcile Accounts

For a guide on how to reconcile accounts in Bluecoins, see the following link:

https://www.bluecoinsapp.com/how-to-reconcile-accounts/

Summary

The balance sheet of Bluecoins is not only one of it’s most powerful feature, but also one of the most important information for tracking and evaluating your personal finance statement. It is highly recommended you regularly review and keep your balance sheet updated. With this, you can identify goals and targets that will help you achieve your goals to achieve greater financial stability.