A budget is an estimation of revenue and expenses over a specified future period of time. Budgets can be made at a personal level, family, business or just about anything where money is generated and spent.

Having a good budgeting plan is always a necessary step in ensuring effective financial management. This post describes how Bluecoins budgeting feature works.

Budget Setup Screen

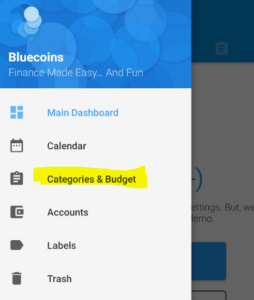

To setup a budget, go to Navigation Drawer > Categories & Budget. It will take you to the category and budget setup screen.

Categories Overview

In Bluecoins, categories (and sub-categories) are used as the framework for a budget plan. The structure of categories in Bluecoins are as follows:

- Expense

- Category Group A

- Category A1

- Category A4

- Category A3

- etc…

- Category Group B

- Category B1

- Category B2

- Category B3

etc…

- etc…

- Category Group A

- Income

- Category Group C

- Category C1

- Category C2

- Category C3

- etc…

- Category Group D

- Category D1

- Category D2

- Category D3

etc…

- etc…

- Category Group C

The category groups and categories can be renamed by clicking on it on the Categories & Budget setup screen.

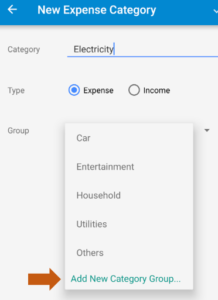

Categories represents grouping of related expenditures or source of incomes. For instance, one may come up with a category group called Utilities and assign categories of Electricity, Water, Cable and Phone underneath it. A typical budget plan would involve assigning an estimated spending amount for each of these utilities for a given period of time, in this case, typically monthly.

How to setup a budget plan in Bluecoins

Adding Category

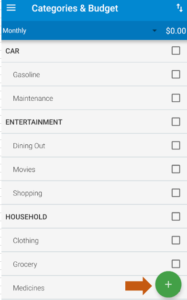

Using the example above to setup a budget plan in Bluecoins, the first step is to create the categories you wished to track. To create categories, click the Add Category button

This will take you to the Category Setup screen. Here you can setup a new category by filling in the name, type (expense or income) and category group. If you wish to create a new category group, simply select the Add New Category… in the selections:

Setting up a Budget

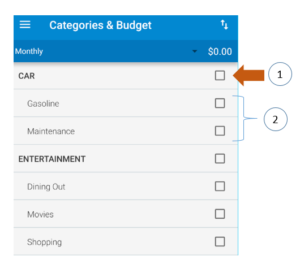

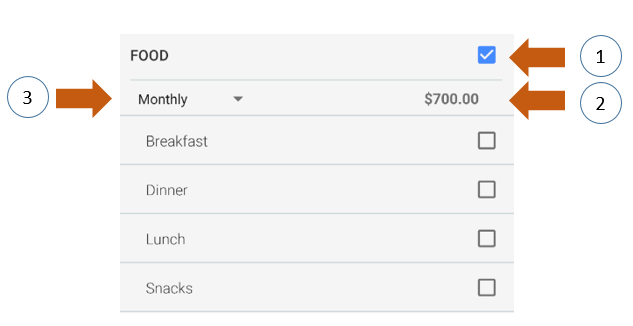

To setup a budget plan, on the Categories & Budget screen, you will be presented with the following. You could setup a budget at either of two levels:

- (1) – Category group level

- (2) – Category level

Budgeting at a Category Group level

There are many reasons why budgeting at a category group level makes sense. Take for example you have setup a category group called Food, and underneath it you have categories called Breakfast, Lunch, Dinner and Snacks. Most people would not specifically allocate individual budgets for breakfast, lunches and dinners but will more likely set aside a budget for food, and this makes sense.

To do this in Bluecoins, click on the category group checkbox (1), and set an amount (2). Clicking on the category group checkbox will also automatically uncheck the budget setting for the categories underneath, if they were set initially. This is because the budget of the individual categories will now be based on the total budget set at it’s parent category group which is now shared by all the categories underneath it.

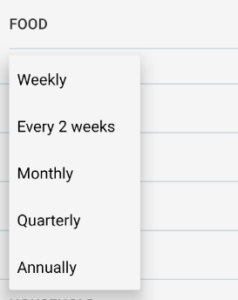

Additionally, you can configure the time-frame for which this budget will be set upon by clicking on number (3) on the above image. Currently, you could set a budget to be in the following time-frames:

- weekly

- every 2 weeks

- every 4 weeks

- monthly

- quarterly

- semi-annually

- annually.

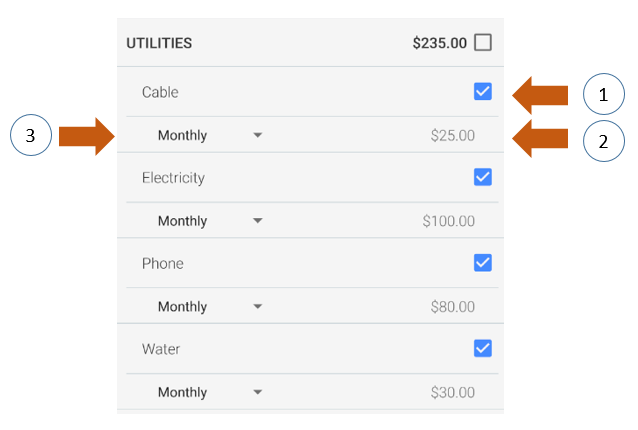

Budgeting at a Category Group level

Setting individual budgets for categories is very common, such as setting a budget for your monthly electricity, water and phone bills. Budgeting at a category level in Bluecoins is as a straightforward as budgeting at a category group level described above.

To do this in Bluecoins, click on the category checkbox (1), set an amount (2). and the time-frame (3). Clicking on the category checkbox will also automatically uncheck the budget setting for the parent category group, if they were set initially. This is because the budget for the category group will now be based on the set budget of it’s child categories underneath.

Budget Summary

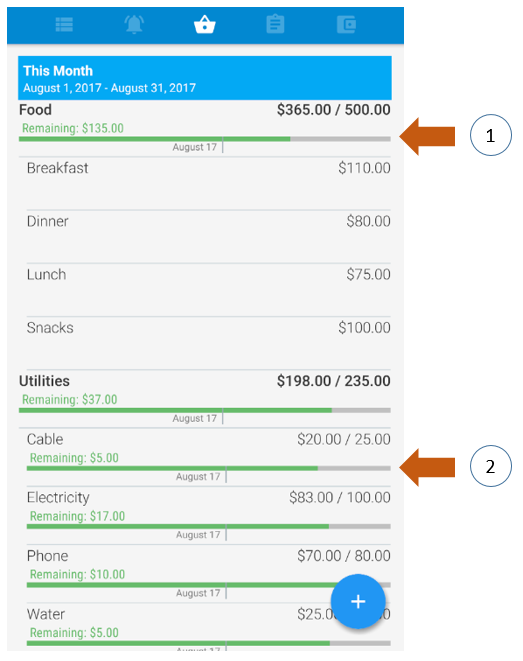

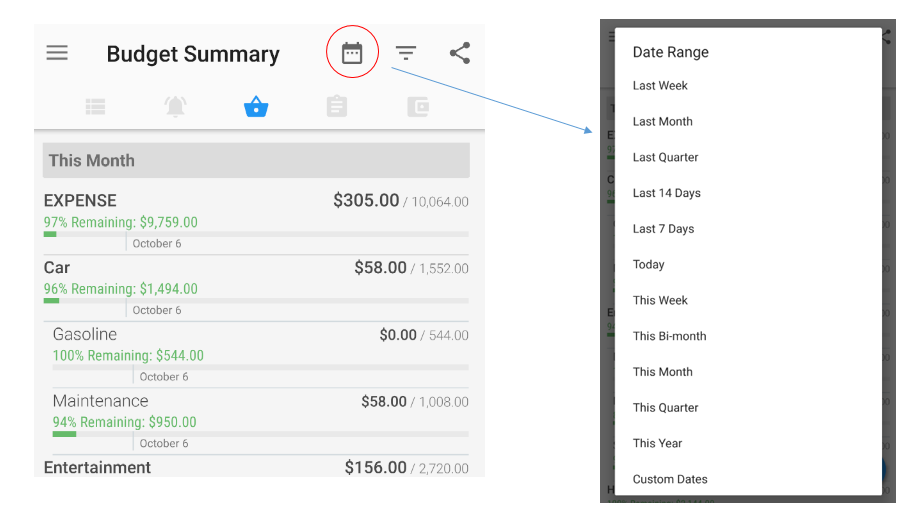

As soon as you enter transactions in Bluecoins, you will be able to quickly see your current budget standing on the Budget Summary tab.

In this summary, you will be presented with a graphical progress bar style summary of your current budget standing. In the summary above, (1) indicates your progress at the category group level, while (2) indicates your progress at the category level.

- The length of the bar corresponds to the total-time frame, in this case monthly as seen on the header bar. You could change this time-frame by selecting the date icon on the toolbar.

- The green bar indicates the progress as a percentage of your total budget. In the example above where it says Food, the total budget as set at 500 while the current spending is at 365. This is displayed as 365/500 above the bar line, and the green stretches to around 73% of the total length of the bar.

- The date corresponds to the current date, relative to where it is from the beginning and towards the end of the budgeting period, in this case, the current date is August 17, so it is somewhere a little over halfway the month of August.

Common Questions

How is the budget for the time-frame calculated?

The total budget for the selected time-frame is calculated based on the proportionately adjusted total of the individual categories. For example:

- Breakfast = 100 every week

- Lunch = 100 every 2 weeks

- Dinner = 300 every quarter

Selected Time-frame = This Month

- Breakfast = 433.33 (~ 100 every week; 52 weeks per year; 4.33 weeks / month average x 100)

- Lunch = 216.67 (~ 100 every 2 weeks; 52 weeks per year; 4.33 weeks / month average x 50)

- Dinner = 100 (300 every quarter; 3 months every quarter; 300 / 3 months)

- Total = 750

Can I set a different budget every month? or every week? or every 2 weeks? etc…

Currently, you cannot set a different budget every month.

- With the way Bluecoins is designed, you could select any budget time-frame such as custom time-frames (e.g. September 12 to October 15 or 34 days) and Bluecoins will automatically calculate the budget for this period using the method described above.

- Each category have their own predefined budget time-frames (weekly, biweekly, every 4 weeks, monthly, quarterly, semi-annually, annually). There’s no setting to set a category budget like April 2017, May 2017, or week of September 1 to 7 2017, etc.

- Specific time-frames can only be set in the first bullet. You need to adjust the individual categories to suit your budget for the target period.

Can I move a budget from one month (or one week) to the next month (or week) or from one category to the other?

No, you cannot move a budget. Moving a budget from one month to another, or from one category to another is typical of envelope based budgeting system based apps. Bluecoins is not an envelope-based budgeting app.

Not all apps behave the same, and oftentimes to gain it’s full benefit a little adjustment in approach is necessary. With the way Bluecoins is designed, when you select a time-frame on the budget summary tab, Bluecoins will extract the summary of the category spending for the given period and compare it with the calculated budget for that given period using the method described above.

For instance, if you need to see if you had an excess from last month’s budget and see if it can be covered within this month’s budget, you can select a 2 month time-frame from the start of last month to the end of the current month and Bluecoins will generate a report of your actual spending versus the calculated budget for this time period. This time-frame operation within Bluecoins can be quickly done, and is just a click away.

Conclusion

This is just a basic summary of the budgeting features of Bluecoins. As you use the app more, you will gain a few more insights and better understanding of how it works and even tailor it to your specific needs.

To maximize the effectiveness of managing your finance using Bluecoins, make sure you have a budget plan in place!