I got this question at least a few times and thought I’ll write a few notes about how to effectively track debts (money you owe from somebody) and credit (money you loaned to somebody) using Bluecoins. First off:

debts and credits are part of your net worth, and they should be managed as such

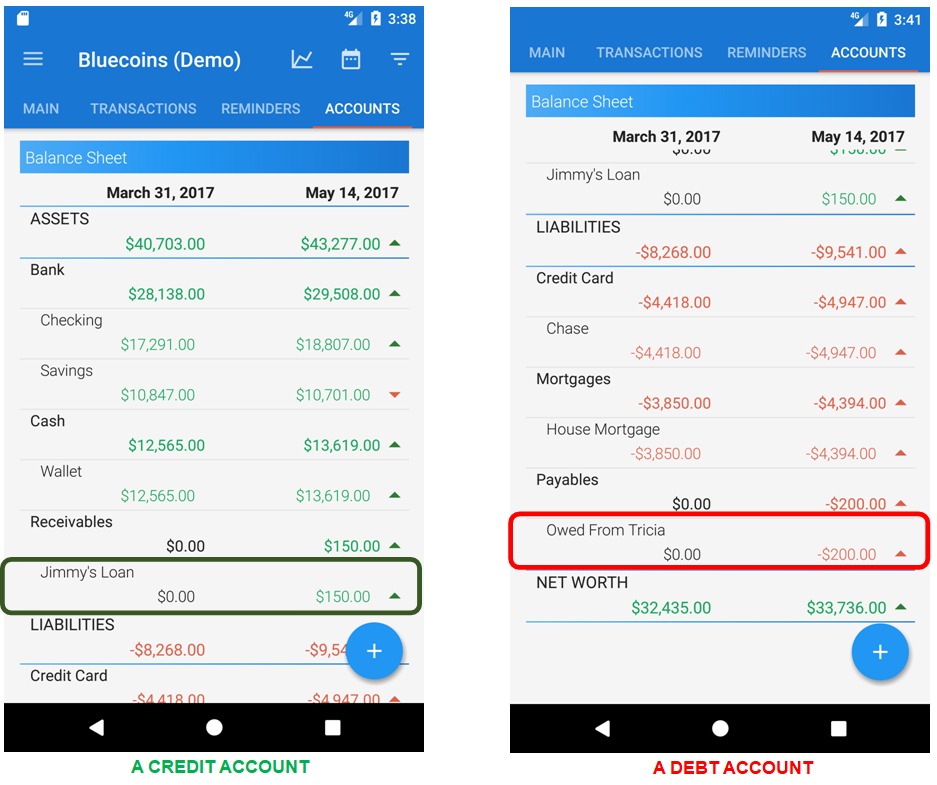

I would typically just create accounts for that under assets (credits) or liabilities (debts). Since they are part of your net worth, when somebody pays you money they owe, whether full or partial, then you simply have to make a transfer from your debit account to the receiving account, for example your wallet. In the picture below, supposed Jimmy pays you a $100 later on out of a total of $150 debt money, then your receivables should decrease by $100, while at the same time increasing the money in your wallet by $100. As a result, your net worth should be the same before and after the loan payment was made. Similarly, when you fully pay your loan to Tricia using your wallet account, then your payables drops to $0 while your wallet reduces by $100. Net should be the same.

To help you keep track of debts and credits, simply create a Transfer Reminder in Bluecoins that will alarm you when this payments or receivables are due in the future. Transfers are simply a way of journal-ling movement of funds from one account to another (read Rethinking Credit Card Expenses for this similar concept).

Let me know what your thoughts or questions are in the comments section below.