This article describes what is cash flow and how it is being monitored and tracked within Bluecoins.

What is Cash Flow

Cash flow measures your cash inflows and outflows in order to show you your net cash flow for a specific period of time, in short- it measures increases and decreases in cash (or cash equivalent).

Cash inflows includes anything that results into an increase in cash. Some examples :

- Salaries

- Interest from savings accounts

- Dividends from investments

- Sale of assets like houses or cars

- Even cash inflow from taking loan

- Many people take debt or loan from banks and financial institutions for expansion of business and its activities, although loan is a liability it results in cash inflow

Cash outflow represents expenses that results in a reduction of cash. Some examples:

- Expenses made from your cash based accounts

- Wallet

- Savings

- Checking

- etc.

- Credit card payments

- Buying an investment (stocks, bonds)

- Important note:

- Expenses made through your credit card are not part of your outflow, although it leads to an increase in expense in your net earnings statement

Cash Flow vs Net Earnings

Cashflow refers to some kind of money movement. You can have a money movement without generating an income or expense, as well as you can have an income or expense without cashflow. For more on this, a great explanation on the difference between cash flow and net earnings is provided on the forum link below:

Link: Cash Flow vs Net Earnings

Cash Flow Setup

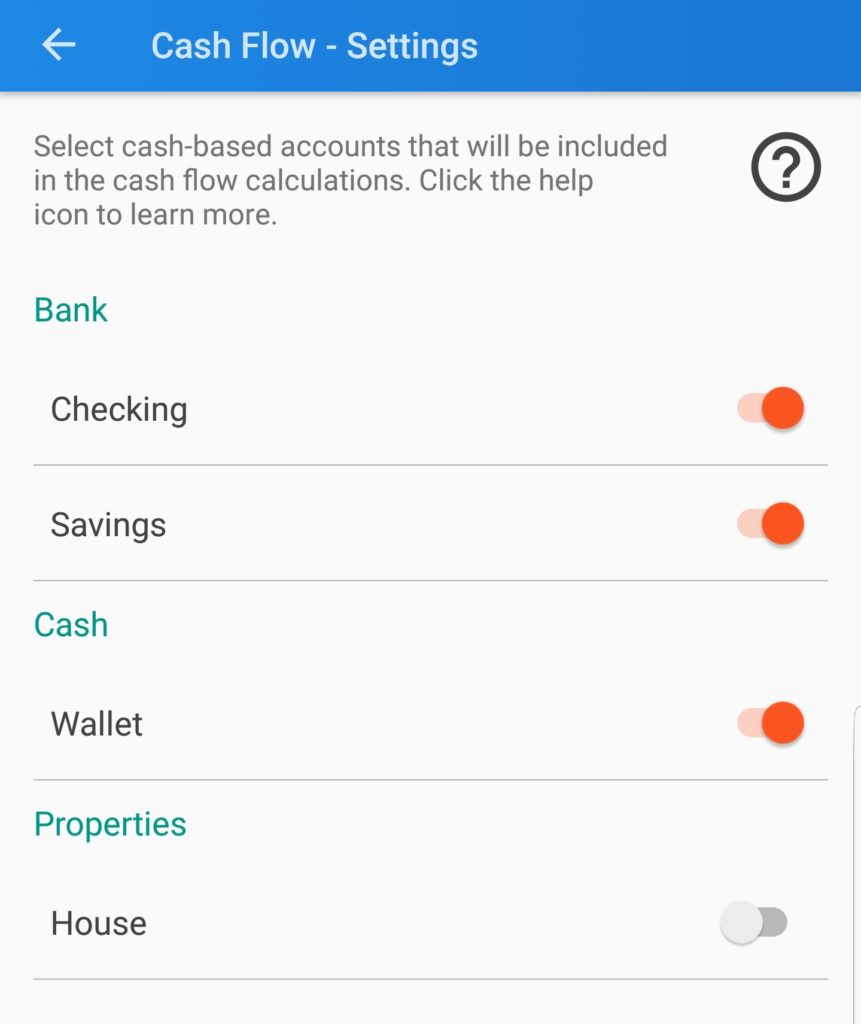

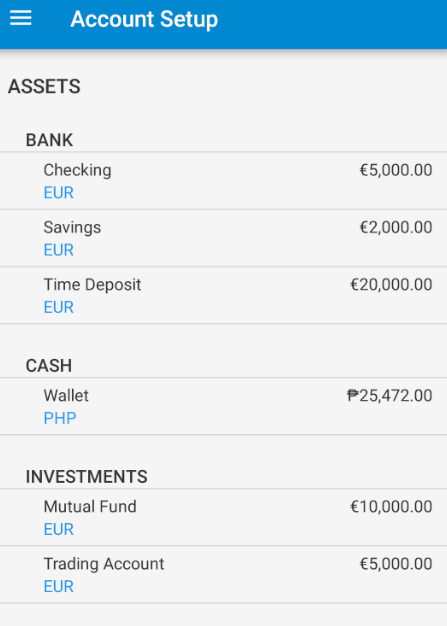

To access the Cash Flow Setup screen, go to Settings > Advanced Settings > Cash Flow Setup or on the Left Sidebar > Account Setup and on the toolbar on the upper right, select Cash Flow Setup.

On the Cash Flow Setup screen, select which asset accounts should be treated as cash based accounts that will be included in the cash flow calculations.

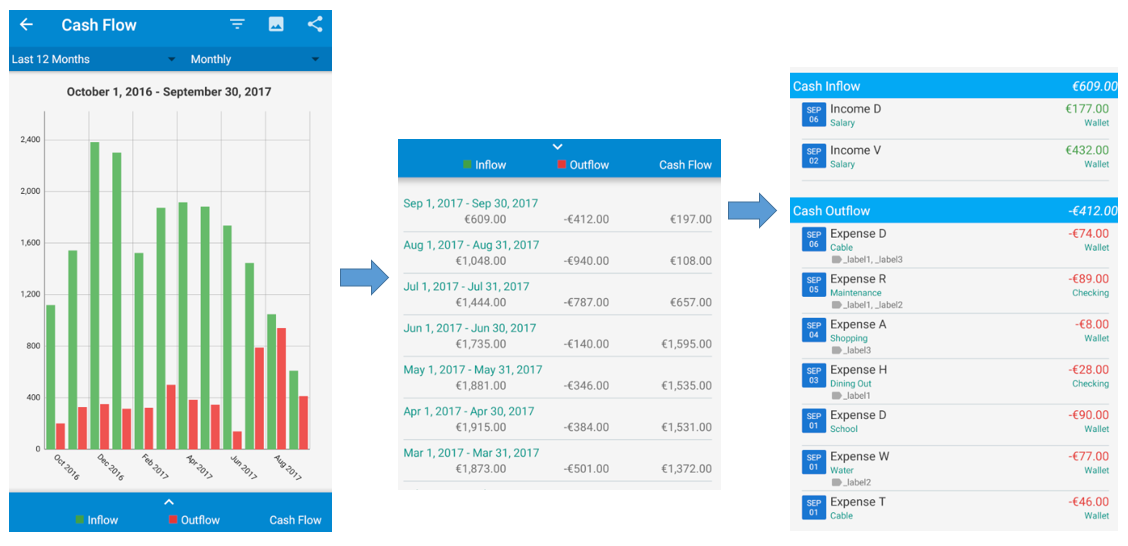

Cash Flow Report

Bluecoins considers any increase in cash (or cash equivalent) assets as part of your cash inflow. Similarly, any decrease in cash (or cash equivalent) assets as part of your cash outflow. Currently, the cash based assets are those accounts that are grouped under bank, cash and investment account groups.

The cash flow card on the main dashboard gives you a quick view of your cash flow summary.

Clicking on the card takes you to the detail cash flow page, up to the individual transactions that affected you cash flow for a selected period: