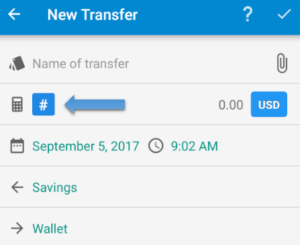

Do you find yourself sometimes withdrawing cash and getting charged for ATM fees? Starting with version 208, when switching to a transfer transaction you will notice a new hashtag sign where the plus and minus is located on the expense and income transaction screen.

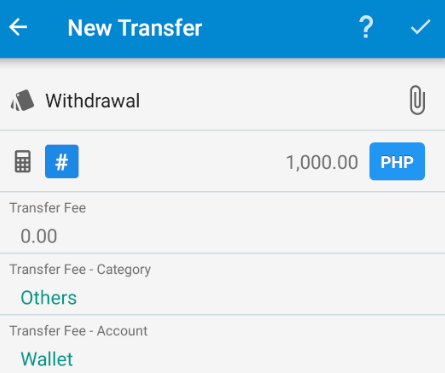

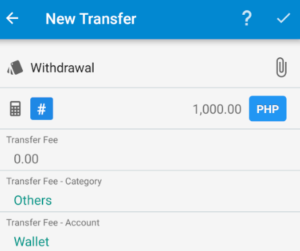

Clicking that button will expand to reveal three new fields in Bluecoins:

- Transfer Fee – use this field to enter ATM fees or other similar transfer charges.

- Transfer Fee Category – transfer fees or charges are expense type. For example, if you withdraw $1000 from the ATM to your wallet, and got charged $5 for the transaction- the $5 is the cost of that transaction. In Bluecoins, all expenses (and incomes) needs to be categorized.

- Transfer Fee Account – use this to field to set what account the fees will be charged against. In most cases, this would be the same as the source (or debit) account. Bluecoins will by default set it to the source account.

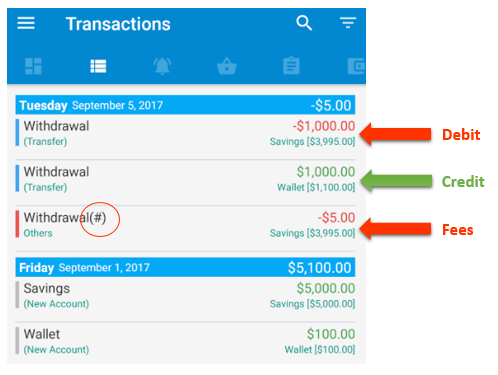

After the entering the transaction, the following entries will be recorded in your transaction tab. For convenience, clicking on any of these will open the same transfer transaction page for editing.

What’s new here is the 3rd entry with the hashtag added to the transaction name. This is the expense entry to cover for the fee or the cost of the transfer transaction. This expense portion of the transfer will be included in all expense reports (net earnings, cash flow, budget reports. etc) where it is applicable.

Other Possible Uses

Other possible uses for the Transfer Fees (#):

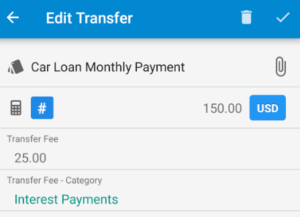

- Account transfers to represent loan or debt payments (e.g. Bank Account to Car Loan) can use the transfer fee portion to represent the cost of the transaction or the interest portion of that transaction. The transfer pair represents the principal reduction (the car loan in this case).

- Any transfer transactions where a cost for that transaction is involved like the ATM withdrawal and the loan example above.